The La Niña Alert: Spring 2020

22nd September 2020

by Midland Insurance

Key points:

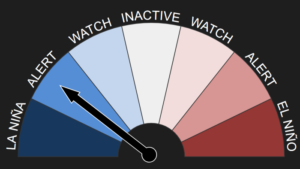

A La Nina ‘ALERT’ status has been issued by the Bureau of Meteorology for the first time since February 2018.

The outlook has recently increased to an ‘ALERT’ status from a previous ‘WATCH’ status, putting the chance of a La Nina in 2020 at 70% which is around three times its normal likelihood. This typically means we are likely to see more (and heavier) rainfall during this years’ spring and summer months, as well as an increased risk of flooding and tropical cyclones.

La Niña typically means:

With this increased risk in mind, homeowners and business owners across high-risk regions need to place awareness and preparation as a top priority to help protect against a potential extreme weather event. See outlook maps below, or online here.

As the reality of climate change starts to really hit home, it’s no longer safe to make decisions on the basis that an extraordinary event is unlikely to happen.

“The BOM’s La Niña watch announcement is a great opportunity for brokers and customers to plan ahead and make sure we’re all prepared and ready if an extreme weather event does eventuate.”

Source: David Gow – QBE’s Head of Major Loss Property Claims

Below are a few preventative steps you can take to better protect your home and/or business in the case of a flood or cyclone event.

Your insurance policy:

Your home or business:

“It’s about being prepared and understanding your exposure, whether that relates to a private residence, or a commercial or industrial occupancy”.

Source: Craig Rogers – QBE Risk Engineering Manager

The New South Wales State Emergency Service houses information and resources to help you plan and take practical actions to protect your assets and understand the risks.

For more information call 1300 306 571 or contact@midlandinsurance.com.au

Comments posted to this page are moderated for suitability. Once your comment has been checked it will be uploaded to the site.